Those who are Wanting a great Va Mortgage Have obtained You to definitely Prior to

With our criteria fulfilled, fix out-of entitlement ought not to bring any more date than just it performed discover an initial round Virtual assistant loan. In short, the process does not get any more tough next big date as much as, nor any further big date then.

Purchasing a house are a perplexing, exhausting techniques in good activities. Of these experiencing it the very first time, the concept can seem almost impossible, particularly when to shop for due to a securely controlled government program. The facts, not, is that the vets we spoke so you can receive the newest Virtual assistant to getting a little of use at each stage of the process, reacting questions quickly and you installment loan agency Cleveland OK may effectively without having any runaround.

They either faith its credit rating is too reasonable, otherwise they don’t have the ability to spend the money for closure charges

Besides, just remember that , it is when you look at the a home loan lender’s best interest to eventually sell you financing–which is how they receives a commission–so they really often keep your hand all of the time, ensuring that folks reaches this new closing dining table willing to sign on the dotted range with a minimum of play around.

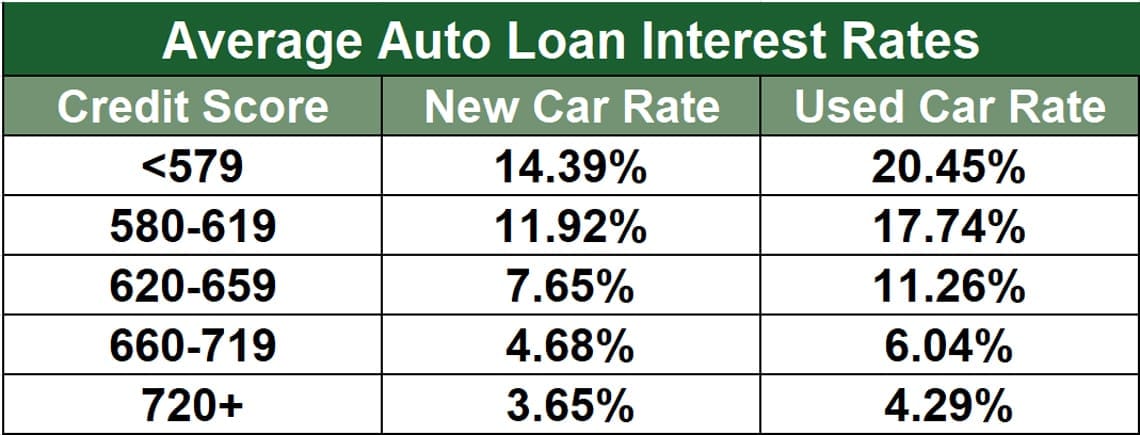

When you find yourself eligibility are a problem (and we will shelter one in more breadth afterwards), as an effective Virtual assistant loan try secured of the regulators, borrowing from the bank requirements are a lot more stimulating

Young very first time consumers will care they will not qualify for Virtual assistant loans for many grounds; they inquire in the event that continued to help you rent is the smoother choice. Otherwise it proper care one deployment, difficulty book to the people from the productive army, tend to disqualify him or her. Credit scores off 620 is actually appropriate, and several lenders will accept even down results.

An additional glamorous element in the federally controlled system is that really closing fees are either waived entirely or relocated to this new merchant of the property, save your self to have sometimes a keen origination percentage as high as step one% the cost of the borrowed funds, otherwise an itemized listing of charge totaling not more than one to same step one%. Really the only other biggest cost–the brand new Va financial support commission–might be financed of the rolling it into the mortgage alone and you can incrementally paying it off through the lifetime of the borrowed funds as a tiny an element of the monthly payments.

Although implementation does complicate things, they cannot stop you from employing this great benefit system. For individuals who deploy through the means of to get property, you just need to score a letter of power out-of lawyer so other class can legally romantic on your behalf. If you’ve currently bought your property and therefore are deployed or sense a personal computers, you get to keep the family and certainly will rent it out to pay for financial. The Va states you can’t have fun with a Virtual assistant loan buying an investment otherwise rental assets, however the laws really just applies to your own intention at lifetime of get. Deployment otherwise Pcs are not items you propose to create; sales is actually commands.

Nearly 25 % million pros exactly who acquired Virtual assistant fund in the 2018 had in earlier times ordered a property using a beneficial Va mortgage, significantly less than repair regarding entitlement. Repair out of entitlement is the procedure where the first time Virtual assistant financing work for try recovered, allowing the new vet or servicemember to try to get and you may discovered an effective the fresh mortgage. Again, to ensure so it that occurs, the initial loan need to be repaid and also the property purchased which have it marketed, otherwise another certified Va mortgage receiver need suppose others of mortgage.

This work with shall be recovered as many times because these conditions try came across. On top of that, there was a single-time-simply entitlement whereby an experienced personal may use a good Virtual assistant financing to shop for a moment household as opposed to attempting to sell the initial, so long as the original financing might have been paid down. So long as the needs for restoration regarding entitlement was fulfilled, the method to possess securing an alternate Virtual assistant financing is pretty quick.