Student loan loans was coordinated which have homeownership, however, which matchmaking is not steady along the existence period

IV. Quote

Within part i expose the findings. First, for the point IV.A we explain some basic correlations ranging from student loan financial obligation and you may homeownership, including just how this type of develop across the lives duration and you can vary by knowledge height. Within the area IV.B we show the results many regressions, wanting to address the endogeneity out of education loan debt of the handling getting observable features. All of our chief identification strategy, playing with an instrumental variable strategy while the procedures/control classification shaping, is actually in depth into the part IV.C. We then present the outcome into the section IV.D. Within the sections IV.E and IV.F we speak about prospective disappointments of your identifying assumptions and you may work with multiple evaluating so you’re able to verify him or her. Finally, inside area IV.G i guess the effect out-of student education loans into the individuals’ borrowing from the bank scores and https://paydayloansconnecticut.com/cornwall-bridge/ you will unpaid updates together with sized their mortgage balance.

A. Patterns regarding Debt and you may Homeownership

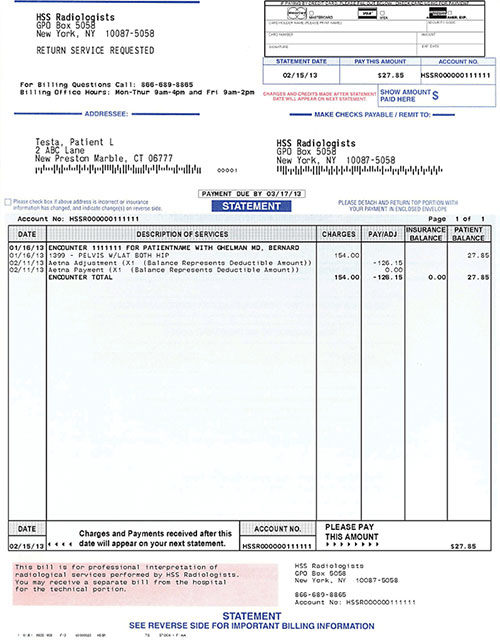

Profile step one plots the possibilities of actually having taken up an excellent mortgage loan up against the individual’s age for several levels of beginner personal debt. Into the shape 1A, i examine individuals who went to college ahead of ages 23 in the place of delivering toward loans having people who performed use and additionally having individuals who don’t sit in university by that ages. Debt-totally free school attendees enjoys a high homeownership price than simply its in financial trouble co-workers at the many years twenty two, but people who have financial obligation hook and go beyond the debt-free classification by the decades 31. In contour 1B, i hone college or university attendees with the around three classes predicated on amount borrowed: no borrowing from the bank, lower than $fifteen,100, and more than $fifteen,100000. College students who use modest amounts start-off less inclined to individual than just nonborrowers however, ultimately get caught up. People who borrowed the absolute most start with the lowest homeownership price at the ages twenty-two but are much more probably be home owners by the age thirty-two (the median chronilogical age of very first real estate, according to the National Connection away from Realtors). From these plots of land you to definitely was tempted to end one to, no less than throughout the medium run, higher student loan financial obligation contributes to increased homeownership rates. Fig. step 1.

Homeownership rates by decades, loans level, and you will education. University attendance and studies attained try defined based on whether men and women have went to school and you will obtained a diploma, correspondingly, prior to age 23. Student loan debt number echo the level of government figuratively speaking paid just before ages 23. Homeownership rate within a given decades is understood to be actually ever which have taken a mortgage from the one to many years.

Determining just how education loan personal debt influences homeownership isnt very simple, although not. People who have different degrees of student loan obligations may also disagree various other crucial indicates. Rather, they could enjoys additional degrees of degree, that’s by itself extremely correlated which have homeownership (possibly using an impact on income). Figure 1C limitations this new decide to try to prospects whom reached an excellent bachelor’s knowledge before many years 23. Within category, those individuals in place of education loan loans usually have a high homeownership rate than just borrowersparing the beds base a couple boards, children which lent more $15,one hundred thousand encountered the highest homeownership rate one of several general school-supposed society just after years twenty seven but i have a low speed certainly one of the newest subset that have an effective bachelor’s education anyway ages. Bachelor’s knowledge receiver with no education loan loans have the higher homeownership rate along side directory of years. As such, simple correlations demonstrably dont capture the whole picture.

B. Selection for the Observables

After that factors which might be correlated having both student loan obligations and you will homeownership (and might be operating the fresh seen matchmaking between those two details regarding number one desire) through the style of school attended, choice of biggest, and local economic climates, like. One potential character technique is to try to absorb each one of this type of prospective confounders which have an intensive gang of manage variables. With regards to comparison with the help of our important variable rates (showed inside sec. IV.D), we run years-certain regressions of an indicator to possess homeownership on student loan bills and other groups of regulation using good probit design. Throughout these and you can further regressions, anyone-top explanatory details (and additionally student loans disbursed) are mentioned after the individual’s 22nd seasons. Most of the fundamental mistakes try clustered in the domestic county peak.