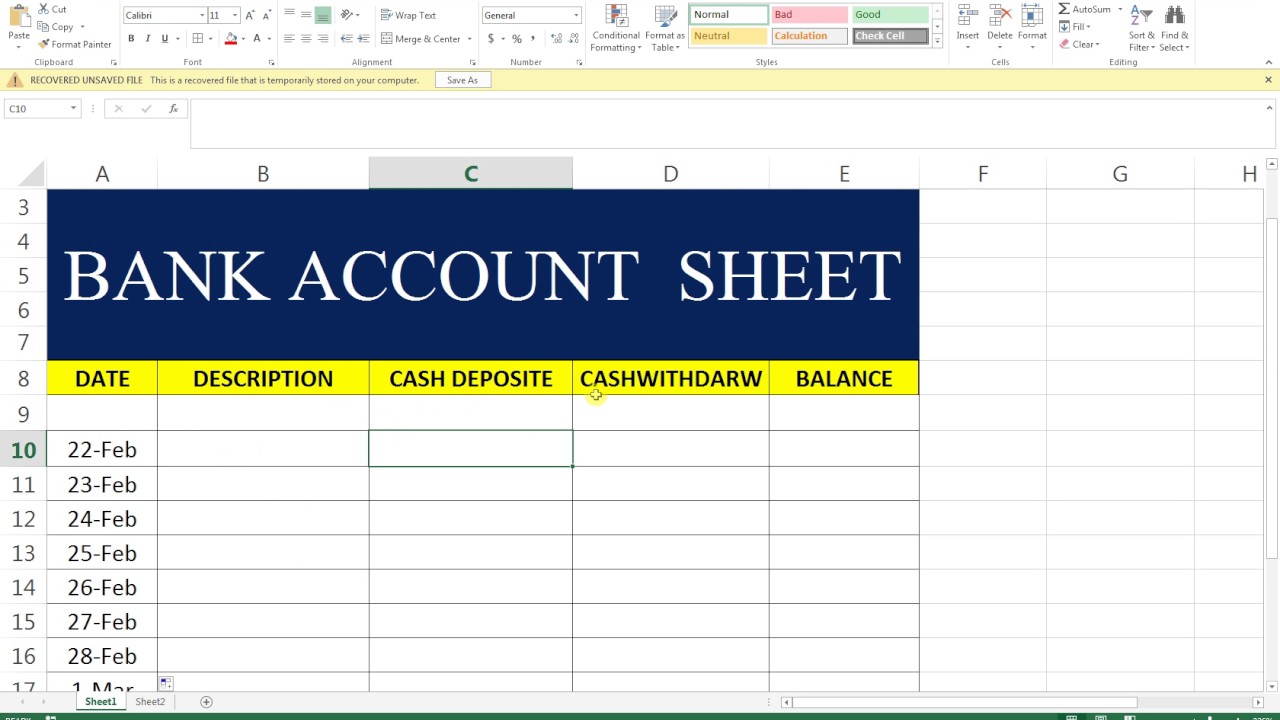

You’ll need to give proof of your earnings and you can bank statements therefore lenders are able to see just how much you may spend

Inspections would-be produced on your own finances giving lenders reassurance you really can afford the mortgage repayments. Any costs you may have would be thought also. If the outgoings each month are considered too high in accordance with your month-to-month shell out, some think it’s more difficult discover accepted having an effective financial.

Loan providers will additionally work on a credit assessment to try and works aside if you’re somebody capable faith to repay that which you are obligated to pay. If you have a track record regarding dealing with your finances, and you may good credit this means that, it may alter your chances of offered home financing.

For those who benefit on your own, one may score home financing when you find yourself self-operating. For many who located advantages, it can be you’ll to track down a home loan towards experts.

Mortgages for less than perfect credit

It could be you’ll be able to discover home financing when you yourself have bad credit, however you will most likely need to pay increased financial interest rate to do so. Having a poor credit get implies to help you lenders which you have educated issues appointment your debt financial obligation prior to now. So you’re able to prevent the risk of dilemmas going on once again, lenders tend to charge you higher rates of interest accordingly. You’re likely to need resource an expert lender for people who has a dismal credit score otherwise an agent that may source you the ideal bank.

What financial ought i pay for?

Delivering a mortgage in theory regarding a loan provider gives you a concept of simply how much you may be permitted to acquire before you could properly use. This will constantly be done in the place of inside your credit score, though it’s not a particular promise regarding the bank which you could be offered a mortgage. Frequently it’s also referred to as an agreement otherwise choice in theory.

Additionally get a good idea of exactly how much financial your have enough money for pay per month, as well as how much would certainly be comfortable spending on the house or property, because of the considering your bank statements. What is your revenue as well as your partner’s if it is a joint financial and you may what are your own normal outgoings? Exactly what can your cut back on and you can what are low-negotiable costs? And you can believe exactly how much you would be capable put down while the a property deposit. It may be you can easily discover a home loan into a decreased money but much relies on the greater circumstances.

Combined mortgages

.webp)

Mutual mortgages incorporate an equivalent pricing because the people you will find using one person financial. not, when you get home financing as you that have others, you happen to be in a position to access down financial rates than just if the you applied on your own. The reason being a blended deposit can get imply you could potentially borrow during the a reduced LTV where rates tend to be straight down. Specific lenders may also envision having several individuals responsible for settling home financing while the safer than simply singular.

The necessity of mortgage in order to worthy of

The loan-to-worthy of (LTV) ratio is when much we want to obtain as a result of a mortgage revealed just like the a portion of the property value your home. So if you’re to invest in a house value ?100,000 as well as have an excellent ?ten,000 deposit, the mortgage amount you prefer was ?ninety,000. It means you prefer an excellent ninety% LTV financial.

The fresh new LTV you’re credit in the make a difference the interest rate you might be energized. Home loan pricing are usually lower within low LTVs when you features a much bigger deposit. Both, preserving a bigger deposit while personal loan no credit check in Oakland, OR maintaining a close observe towards the possessions prices you will push you to your a lower life expectancy LTV class, where rates is finest.