Latest Home loan Pricing by Credit rating | 2024

Exactly what financial price am i going to get with my credit rating?

If you are a credit history off 740 generally secures a reduced cost, consumers which have modest credit can still get a hold of aggressive choices by way of particular loan types.

Think of, your credit score is the one bit of the brand new secret. Therefore let us talk about all of your options to make certain that you are acquiring the reasonable rates easy for your credit rating.

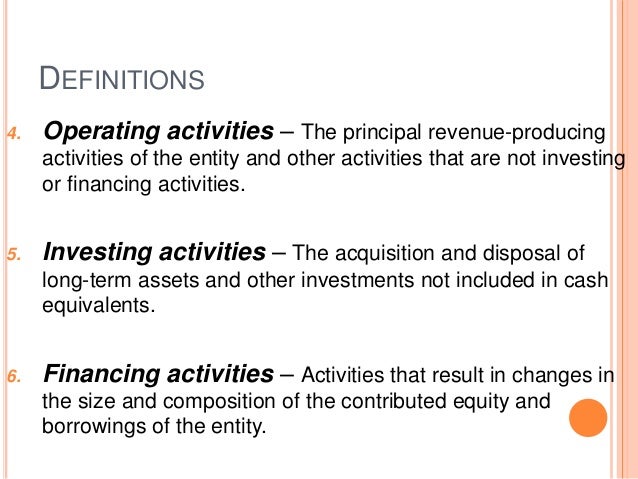

Just how fico scores apply at financial cost

That it rating is a mathematical measure of your own creditworthiness, based on things for example percentage background, complete debt, sort of borrowing made use of, and duration of credit rating. Higher scores fundamentally lead to straight down home loan rates, due to the fact lenders understand your because a lesser-exposure debtor.

Fico scores have decided by the credit bureaus including Equifax and you can Experian. The complete comparison helps loan providers assess the chance of lending so you’re able to you.

Borrowing from the bank levels in addition to their effect on mortgage rates

Mortgage lenders have a tendency to explore borrowing levels to decide interest levels, which can be based on Credit scores. FICO, short for Reasonable Isaac Business, is actually a widely used credit rating model. We have found a review of regular borrowing levels as americash loans Hobson well as how they connect with mortgage cost:

Financial cost of the credit history

Financial rates may differ notably according to credit scores, causing reasonable variations in monthly home loan repayments and you will a lot of time-identity focus costs for property owners.

FICO, the biggest credit reporting company when you look at the Western a home, will bring a good online calculator you to definitely depicts how much mortgage rates may differ according to fico scores. Just to illustrate off just how average annual percentage pricing (:

Mortgage repayments from the credit history

We will fool around with that loan number, and also the ple to display exactly how borrowing from the bank tiers impact mortgage repayments and you may long-label interest will cost you. For people who compare the best and you will reduced credit history tiers, brand new borrower having better borrowing from the bank conserves throughout the $445 per month and you will $160,200 in total interest along the life of its home mortgage.

*Percentage instances and ount away from $405,eight hundred and you may a 30-seasons fixed-price real estate loan. Their interest and you may monthly payment will change.

And additionally mortgage pricing by the credit rating, home prices and mortgage insurance coverage can also be considerably impression your own month-to-month financial costs, particularly in higher-prices parts such as for instance Nyc. Using a home loan calculator can help you imagine these will cost you and you will examine various other financing solutions.

Traditional fund wanted individual financial insurance policies (PMI) having off costs below 20% of the home price, when you find yourself FHA financing have both upfront and you can annual home loan insurance fees (MIP).

The type of financing you select, including a fixed-price otherwise varying-price home loan (ARM), may affect your own interest and you will much time-label will set you back. Think about your finances and you may goals whenever choosing that loan getting your primary residence.

Financial cost by the financing type of

And credit rating, mortgage prices along with are different because of the loan particular. Listed below are some popular mortgage models and their normal rates.

Old-fashioned mortgage rates

Antique funds may be the most frequent particular mortgage and typically provide competitive pricing for consumers with a good credit score. Prices are some greater than getting government-backed money particularly FHA otherwise Va. The current home loan price to own traditional funds was % ( % APR).

FHA mortgage cost

The fresh Federal Property Management promises FHA financing, that is the reason they often times has actually all the way down cost than traditional fund. The present home loan speed getting FHA funds is actually % ( % APR). This type of fund shall be recommended getting earliest-date homebuyers having lower credit scores or limited deposit financing.

Va mortgage costs

Virtual assistant financing are around for qualified armed forces provider professionals, veterans, as well as their spouses. They frequently feature all the way down rates than just old-fashioned money and don’t wanted an advance payment. The current home loan rates having an effective Va financing is % ( % APR).