Buyer beware. from how much cash you could potentially « afford »

With regards to the new measures in buying a home, probably the initial (and you will first!) you to definitely you will want to simply take is getting approved to own a mortgage. There are a number of things their mortgage lender commonly thought when deciding how much house you really can afford, you to are the debt-to-money proportion. Here is what you have to know with respect to determining how your debt could affect your capability to carry out home financing toward property.

What’s a financial obligation-to-income proportion?

Your own lender will do an easy calculation, looking at their monthly debts along with your month-to-month earnings source, which will show the debt payment. So it proportion paints a picture of debt energy and suppress you against buying property that you may possibly not be able afford. Exactly what points enter into your debt-to-earnings ratio? Generally, the reduced the debt as well as the highest your revenue, the greater amount of you’ll end up acknowledged to own. In most cases, a loan provider will require your own overall financial obligation-to-income ratio becoming 43% otherwise faster, therefore it is important to be sure to meet this traditional in order to qualify for home financing. Addititionally there is a construction proportion one lenders consider, which is less than the full DTI ratio. Property proportion ‘s the the fresh suggested fee, taxation, insurance rates, HOA, etc. rather than gross income. Loan providers like it to be as much as 30% otherwise smaller, as a general rule out of flash.

Once the loans-to-money rates is actually determined using revenues, which is the pre-tax count, it is preferable to be traditional whenever choosing what size away from home financing you feel comfy taking on. You ount may imply way of living paycheck-to-salary instead of being able to cut a number of your earnings each month. Also keep in mind, when you find yourself into the a higher income group, the fresh new portion of the net gain that would go to fees will get getting higher.

If you’re your debt-to-income ratio is calculated utilizing your revenues, believe basing the calculations in your net gain getting a even more realistic look at your finances and what number you will be comfy spending on a house.

Self-a job can affect your debt-to-income ratio

Self-a position is typically found-just after towards www.paydayloansconnecticut.com/moosup the liberty it offers while the capability to really works regarding no matter where you select. More often than not, a form 1099 may come towards gamble if you have done independent functions (such as for example an excellent freelancer). You employ the latest 1099s so you’re able to declaration terrible income, up coming cause of one deductions, expenses, write-offs, etcetera. in order to determine your own summation profit or loss. Brand new profit or loss is what the lending company looks at, in addition to 1099s is the help documentation that is required . To make sure that yourself-a job income getting included:

You will need let you know structure inside your company, while the severe declines or change about past seasons when it comes cash could prove problematic when being qualified to have a home loan.

Such as for instance, we has just purchased a house, of course, if checking out the lending process, my personal lender calculated my personal income earned away from worry about-employment wouldn’t be studied when calculating our personal debt-to-income proportion due to the fact I did not but really has two full many years of uniform money. This showed up since a massive shock for me, but when i talked with my lender, I know the necessity of earnings balance.

Their student loan personal debt issues

To the millennial age group, saddled which have education loan personal debt and more than half of not knowing exactly how much time it will require being financial obligation-free, getting a home loan shall be an excellent trickier processes. This is because the student loan debt try factored in the debt-to-money proportion. Like, home loans insured by the Federal Construction Management actually needs your student loan debt is evaluated 1 of 2 means: Their financial must fool around with:

The greater amount of of: one percent of the the college student personal debt harmony can be used if you don’t see your envisioned payment, and/or monthly payment since the claimed with the credit file

In the event the loans are currently inside deferment, they are counted inside your obligations-to-income ratio. Very, as you care able to see, your own student loans have a giant affect what you can do to help you borrow money to find a house. For every system may vary, therefore don’t forget to speak to your lender throughout the education loan direction.

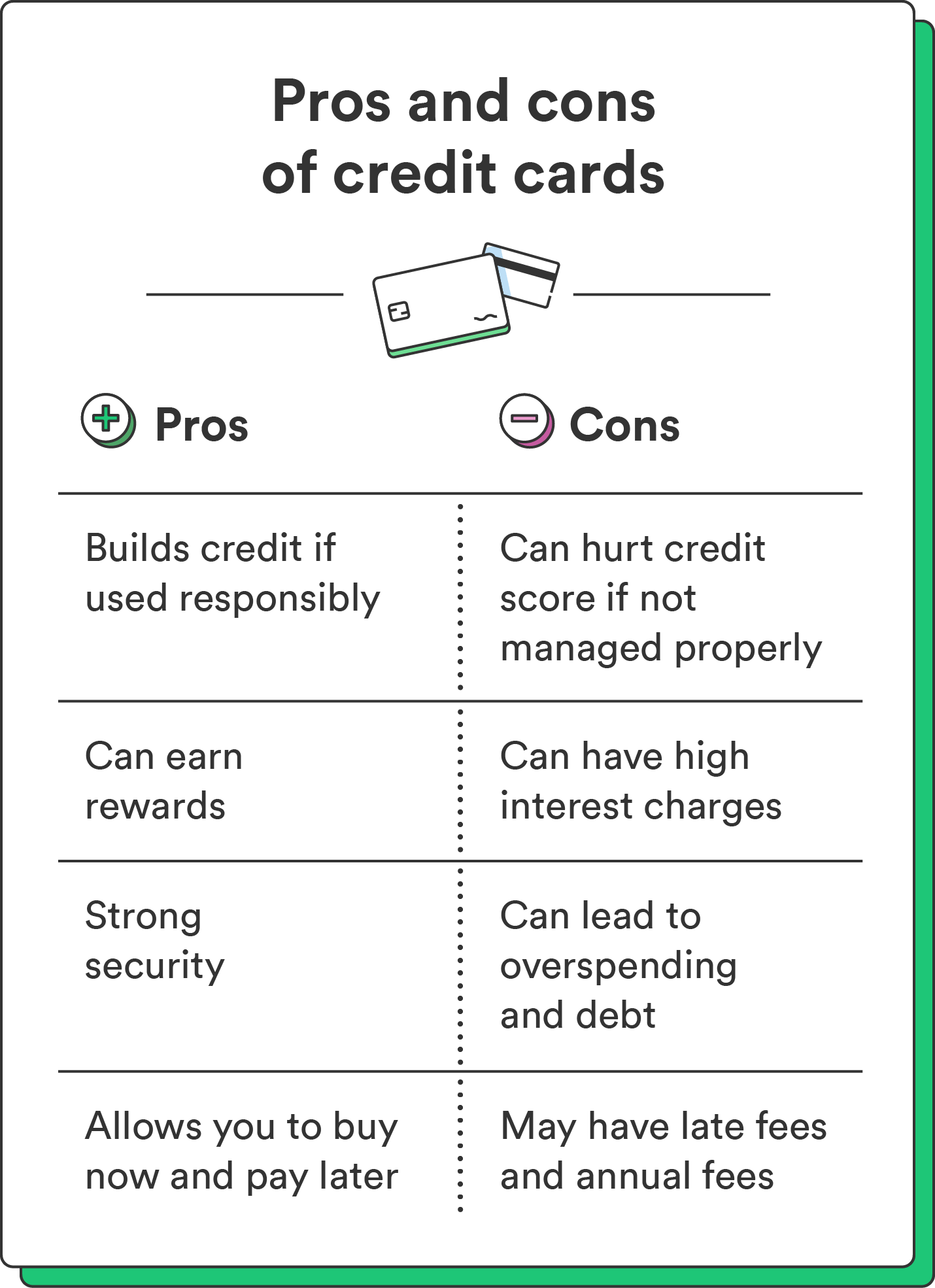

Boffins learned that more 38% off American houses hold no less than some kind of charge card obligations. Whenever you are one anyone, you should be aware of one’s effects it may have into the debt-to-income ratio. Your own bank card monthly minimal costs is factored in the personal debt-to-earnings ratio, so maintaining your balances lower will be vital whenever making an application for a mortgage. Not to mention, their credit worthiness belongs to the mortgage application process, making it also essential making your own monthly payments on time and you may limit the level of borrowing concerns on your own identity inside buy to maintain an excellent credit rating.

Simple tips to change your financial obligation-to-money proportion

If you’re thinking about purchasing a property, it is best so you’re able to estimate the debt-to-income ratio within the planning procedure. This will help you know if you’ve got the 43% or shorter personal debt-to-earnings proportion you to a majority of lenders want. If you discover that your particular obligations is actually high, it will be smart to begin dealing with some of those balances or looking for even more money source for having a knowledgeable likelihood of qualifying to have a home loan. Check out getting already been:

Play with credit cards sparingly. The only way to decrease your month-to-month costs is always to spend off your debt, so if you continue using their handmade cards and hold an equilibrium, you might not be able to reduce your monthly expenses.

Remain particular suggestions of your notice-employment earnings. When you possess at the least 24 months of self-a career below your gear, if you don’t have the necessary tax facts to give cerdibility to your income attained, it can be difficult to get a mortgage.

Avoid taking right out most other financing. Knowing to purchase a home is on the latest panorama, meticulously believe the manner in which you purchase your finances. May possibly not be the ideal time to purchase an alternate auto and take away financing having a special band, since these could well be factored into the obligations-to-money proportion.

Unlock a savings account. Start rescuing today, and those dollars will begin accumulated! Putting a big advance payment on the a home wil dramatically reduce this new number you need to obtain, for example an inferior homeloan payment and you may a reduced loans-to-money proportion.

Due to the fact mortgage techniques is going to be complicated, knowing the some other standards makes it possible to get ready beforehand, thus you should have a greater threat of qualifying to own an effective brand new home. While prepared to do the step into the homeownership, get in touch with a mortgage banker today.