Criteria to have Family Guarantee Funds For the 2023

Tapping into new equity you have got of your house was a good popular way to acquire. Home collateral loans keeps lower-interest levels, the money you obtain can be used for a variety of one thing, and versatile installment terminology advice about cost management.

When you find yourself thinking about trying to get property collateral loan, the next report about the prerequisites having 2023 helps you determine if you are able.

How can Household Collateral Money Work?

House guarantee finance is actually preferred borrowing alternatives for residents because they enable you to use the guarantee of your home since equity. Since the financing is shielded, you have a lower life expectancy interest than you’ll with other borrowing solutions.

House equity money act like unsecured loans in how it works. When you’re approved, you’re getting a lump sum payment on full number initial. The rate could well be repaired, and you may pay it off that have equivalent monthly obligations over a predetermined name.

The quantity that one may acquire with a house guarantee mortgage may differ, while most loan providers enables you to obtain to 85% of your property security.

Terminology having household security funds are often 5-two decades. It does differ according to amount borrowed, the financial institution, or any other facts.

It is important to remember that for individuals who offer their domestic, you will be needed to pay off the remaining harmony of your house collateral loan right away. Simply because the mortgage has stopped being shielded with guarantee. Brand new proceeds from the latest marketing of your property can be utilized to settle the mortgage.

House Security Mortgage Conditions

The needs so you’re able to be eligible for property equity financing vary with respect to the bank. It is essential to keep in mind because you think about your choices, although not, one to borrowing from the bank unions normally have down cost and charge than just financial institutions. They also often have far more discernment within their financing choices.

Credit history

Your credit rating is an important factor that a lender tend to think when contrasting your to possess a property security financing. Good credit implies that you had been accountable for paying off your financial situation prior to now. It tells lenders you will most likely carry out the same with a brand new mortgage.

At least credit score from 620 is frequently necessary to be considered to have property equity mortgage, regardless of if a get away from 680 or maybe more is advised. Yet not, a loan provider may agree you for a financial loan that have a reduced get if the prerequisites try fulfilled.

If you wish to improve your credit history before applying to possess a loan, there are certain things you are able to do. For just one, make sure all information regarding your credit history was particular because the problems are now and again produced in credit rating.

If you find a mistake, it is important to conflict they towards the revealing bureau just that one can. The 3 credit reporting bureaus are Experian, Equifax, and you can TransUnion.

You’ll be able to have the ability to replace your rating that with just about 31% of your offered borrowing simultaneously. When you yourself have a great $ten,000 mastercard restriction, such as for instance, while currently have $4,000 recharged to your card, you could potentially pay-off $step 1,000 to get less than 31%. You may manage to slow down the part of offered credit you are playing with from the asking for a borrowing limit improve.

Household Guarantee

Their lender would want to definitely have enough collateral in your home to purchase amount borrowed. Household equity is the amount of your house that you own. If you buy good $300,000 house with a beneficial $fifty,000 downpayment, including, you should have $fifty,000 home based security after the closure.

Home collateral together with expands in the monthly payments you make towards their mortgage while the worth of your house values. Minimal number of collateral expected to qualify is generally fifteen% so you’re able to 20% of your worth of your property.

Most recent Expense

Just before approving your loan application, the financial have a tendency to review your current expenses to make sure you are not overextended. If you have multiple personal debt costs monthly, discover a go you to including a special loan you could end up missed payments.

To check your existing costs, your financial tend to consider carefully your debt-to-money (DTI) proportion. The fresh new DTI proportion is short for the new percentage of the month-to-month earnings that happens on repaying the monthly debts. The lower your own DTI ratio, the greater.

Of a lot loan providers have a tendency to approve you to possess a house collateral mortgage which have a great DTI ratio out of 43%, however some commonly like a reduced count. It does just count on new lender’s taste.

If for example the DTI ratio is higher than 43%, you can treat they by paying regarding the your debts before you apply to have a separate financing. You could start to the littlest financial obligation, repay it, after which move on to next smallest loans for some small victories.

Income

Your revenue might possibly be examined to ensure that you secure enough to settle the bucks your borrow. The work history can also be believed. Individuals with regular work records is less risky borrowers.

You can find ways that your own work and you may income will be analyzed. Several data files you might have to render are:

- W2 variations

- Tax statements

- Bank statements

- Page from your workplace

Household Guarantee Funds Having Freedom Credit Commitment

When you are thinking about experiencing the new equity of your home, Liberty Borrowing from the bank Partnership also offers a property security mortgage with an intention rates which is lower than the majority of finance companies offer.

Instead of of many lenders one to just allow you to borrow up to 85% of your home equity, we loan as much as 110% and don’t add one cashadvancecompass.com check cashing open near me application charges otherwise closing costs into the all of our home collateral money. Together with, most of the loan conclusion manufactured within branch peak. It means it’s not necessary to value the loan decision are created by some body far away which have not actually fulfilled you.

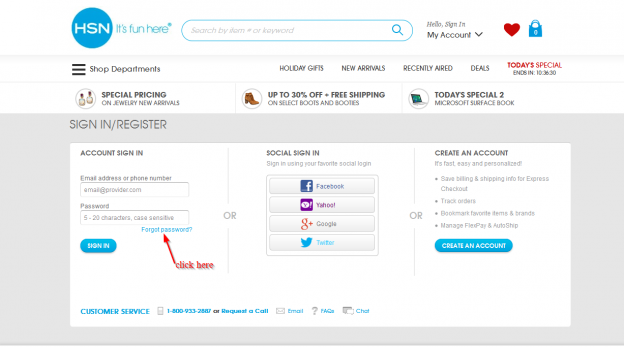

Click the following relationship to learn more about our home guarantee financing. You are better than do you consider to discover the money you prefer!