cuatro. Just who Should get an effective Jumbo Financing?

- A massive downpayment: Of a lot americash loans Glen Allen lenders will require a downpayment regarding 20%, although it could be you’ll be able to to get off merely 10%. If you wish to lay out a little down payment, the borrowing, income and cash reserves will need to be higher still.

Lenders tend to be choosy towards individuals it approve having jumbo finance, when you want to make yes you be considered, you can also manage gathering your own borrowing and you may possessions.

A good jumbo home loan is not designed for anyone to get alot more domestic than just they could fairly afford. Jumbo mortgages is actually of these homebuyers that happen to be financially safer and you can are interested to buy property that is higher priced compared to average possessions. You can search up the constraints towards the conforming fund on your town to choose in the event your dream home exceeds the newest maximum, while it will, you’ll be able to explore applying for a jumbo home loan.

Jumbo mortgage loans is going to be an excellent option for young positives starting off within the its jobs who will be making a leading income, but just who maybe don’t possess extreme info built up as of this time. If you find yourself a top-money earner to make $250,000 so you’re able to $five-hundred,000 a year, and you are clearly looking to buy a costly house, a great jumbo mortgage could be a option for you.

What exactly is a compliant Loan?

Conforming financing get their name because they adhere to the newest variables put by Freddie Mac computer and Federal national mortgage association. Financing terms and conditions are realistic, prices and eligibility to have compliant fund are standard, and you may rates of interest will likely be below non-compliant finance. A compliant financing is even called a normal financing and that’s the most used types of home loan.

step one. Why does a compliant Financing Performs?

As conforming financing realize Fannie mae and Freddie Mac computer guidance, he is widely recognized because of the loan providers and you can mortgage issuers. Money you to follow requirements are simpler to offer and get.

Exactly what all the compliant financing have in common are their demands getting a down-payment, credit rating, loan limit and you may financial obligation-to-earnings ratio. Compliant fund are not supported by authorities businesses, very FHA money, USDA funds and you can Virtual assistant finance aren’t considered conforming funds, since they are all of the backed by the government.

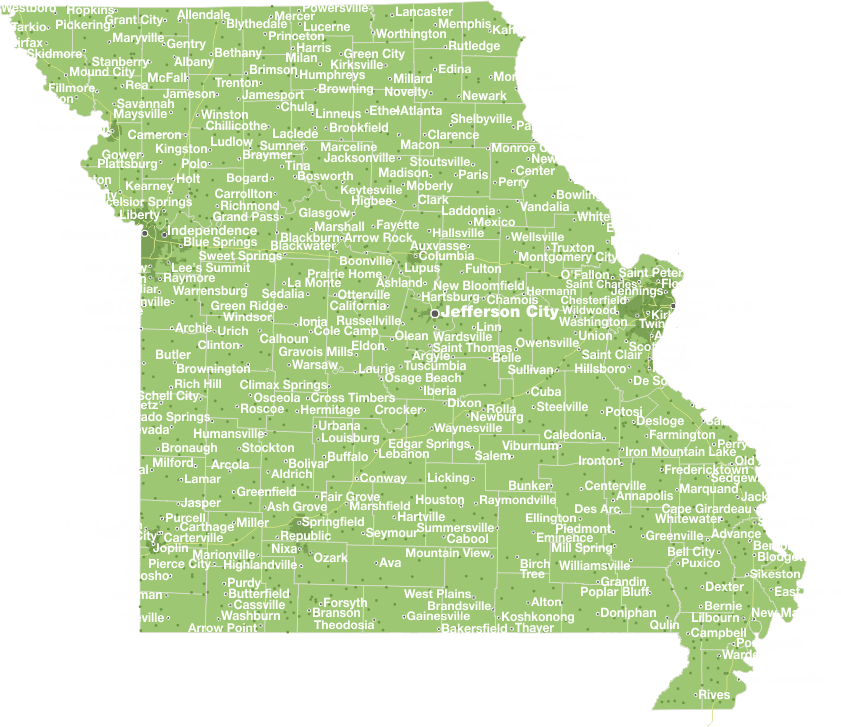

Conforming mortgage loans have loan constraints. For just one-device properties, the newest 2019 maximum are $484,350 in most of the nation, but within the counties with competitive homes locations, and this, highest home values. Regardless, there’s however a limit to have aggressive locations, that’s 150% more than the base limitation. Currently, so it absolute limitation was $726,525.

The degree of interest you’ll pay on the compliant financing would depend toward interest your and get therefore the amount of their mortgage title. Eg, you could select from a thirty-seasons or 15-seasons financial. For a thirty-season financial, it is possible to spend a lot more desire, however your monthly payments will also be less than having a beneficial 15-12 months mortgage.

If you fail to put about 20% off, you will probably need to pay personal financial insurance fees. PMI handles the lending company if you cannot create your home loan repayments, but that it insurance coverage does not cover you, the latest debtor.

dos. Do you Re-finance a great Jumbo Loan Toward a conforming Loan?

If you’ve secure an excellent jumbo loan, you’re wanting to know whenever you can re-finance your loan into a compliant financial. Though it is achievable, refinancing should be problematic. Dependent on your position, it can be really worth the effort whether or not it form big savings by removing your monthly premiums as well as your rate of interest.

- A FICO rating of at least 660

- A loans-to-earnings ratio lower than 43%