Income Requirements having FHA Funds from inside the Fl

To get a homeowner can seem to be for example a much-fetched fantasy for some younger Us citizens. Saving up adequate having a downpayment is in by itself good endeavor. Exactly what possibilities have you got when you lack 20% to put down on a house? And with soaring home prices and you can ascending interest rates, you can manage home financing?

The good news is, individuals with complications protecting for a deposit otherwise less than stellar borrowing can get be eligible for an enthusiastic FHA financing. Read on to learn about FHA loan requirements for the Florida and you will the way to get a florida FHA loan regarding the benefits at the The Lovers Financial out of Fl, Inc.

What is actually an FHA Mortgage?

In the 1934, Congress developed the Government Property Administration (FHA) to greatly help significantly more Us citizens afford homeownership. But not, at that time, people wanted to lay out a fifty% downpayment after which experienced hopeless financing terms that every you may never ever pay off.

The intention of the brand new FHA would be to clean out lenders’ chance and allow easier for Us americans locate mortgage brokers. Hence, the latest FHA assures otherwise guarantees most of the FHA mortgage software. This means for people who default on the mortgage fee, government entities pays your own mortgage lender.

Regardless of if most commonly known with very first-big date homebuyers, several kinds of FHA funds can be found. For example this new FHA 203K Upgrade Loan to finance fixer-uppers. Refinancing is also possible toward FHA Effortless Refinance. This might be for those that have to change a current FHA mortgage with a new repaired- or variable-price loan.

The borrowed funds count you can found hinges on new FHA financing constraints for your county. For many Fl counties, the brand new restrict are $420,680. But not, this might rise to help you $970,800, according to your location.

FHA Home loan Rates of interest

Specific FHA finance has all the way down interest levels than just antique money, however FHA home loan prices was highest. Multiple situations apply to interest rates, for example:

- Credit score

- Down payment size

- House rates and you will amount borrowed

- Interest type of

- Loan terminology

- Location

Which are the FHA Loan Conditions?

Basic, you need to pick a primary quarters. Very play with a keen FHA home mortgage buying an individual-family home. For example apartments, townhomes, and you may are manufactured home towards a permanent basis. You could have fun with an FHA mortgage having a beneficial multifamily domestic. Our home might have doing five tools, therefore have to are now living in one of loans Fort White FL them.

FHA Credit score Demands

You would like a minimum credit score out-of 580 to be eligible for an FHA loan . (Comparatively, minimal credit rating to own a conventional mortgage is normally 620.) This does not disqualify those with straight down fico scores, even when.

You might nevertheless make an application for a keen FHA financing whether your FICO rating are anywhere between 500 and you can 579. Possible only have to set-out a larger down payment.

Otherwise discover your credit score, you might manage a totally free credit history to the yourself to look for out in advance of examining financial solutions.

At the same time, you may still be eligible for an enthusiastic FHA loan for folks who have a woeful credit score due to a previous bankruptcy processing otherwise foreclosures.

Income qualification to possess FHA money is extremely different from traditional funds. The reason being there’s no minimal monthly money required and you will zero limitation salary that disqualify borrowers.

not, you must show you has actually a sufficient, steady earnings. Whenever acquiring home financing, lenders want to see to rationally spend the money for household you should pick.

Minimal advance payment of these which have a credit rating out-of 580 or higher are 3.5%. People who have a get out-of five-hundred in order to 579 will have to lay out 10%.

Certain old-fashioned financing need a good 10% down-payment, but you’ll likely have a high interest rate. Most conventional mortgages need a good 20% deposit.

For people who however do not want a step three.5% advance payment, there are advance payment assistance programs to simply help. This new U.S. Department out-of Casing and you will Metropolitan Creativity (HUD) gives houses provides to state governing bodies and pick municipalities to greatly help with property will set you back.

Just remember that , along with the downpayment, you must get ready to spend closing costs or perhaps the expenditures called for doing the real home purchase. They are:

- Appraisal

- Document preparation

- House assessment

FHA Debt-to-Earnings Proportion Rule

FHA financing certificates within the Fl wanted consumers to own an obligations-to-money proportion (DTI proportion) below fifty%, though some loan providers enables good DTI proportion as high as 57%.

It indicates the internet money you may spend on month-to-month financial obligation payments doesn’t exceed 50% of your own monthly money. Types of this type of monthly premiums become:

FHA Called for Files

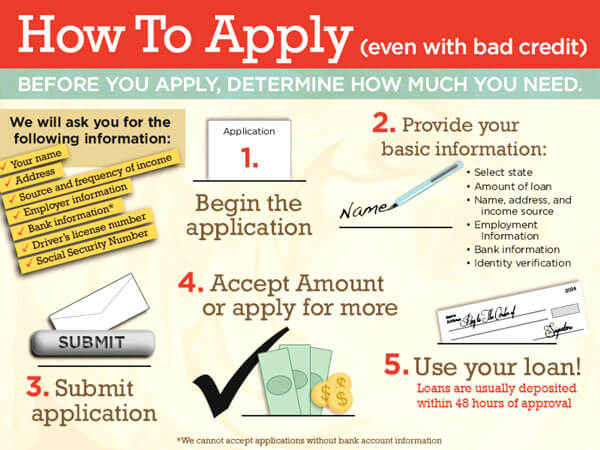

After you have the brand new records, you can finish the pre-acceptance process that have Couples Financial. Providing pre-acknowledged makes it easier to pick property because you can show the vendor you currently have the amount of money.

Let us Make it easier to Safer Your FHA Loan

When you are willing to transfer to your ideal household, implement today having Couples Financial to obtain pre-recognized to suit your FHA financing and support the financing you prefer so you can in the long run become a resident.

On Associates Financial away from Fl, Inc., i improve the loan app technique to enable it to be simple and stress-free. We work with borrowers off all of the backgrounds, in addition to nontraditional of these, to find the correct mortgage for you to help you build homeownership a reality!