Learn more about How exactly to Re-finance Your house and you may Exactly what your Choices are

After you refinance your home, you have to pay out of your existing home loan and you will change it with an effective another one. You could potentially decide refinancing is sensible when deciding to take benefit of lower rates, get better financing words, pay-off your loan quicker, or treat home loan insurance. Whenever you are thinking ideas on how to refinance a home, listed here are very important steps you will have to bring.

How exactly to Determine whether It’s a good idea so you’re able to Refinance

Just like the you will likely spend closing costs once you re-finance, you’ll want to weigh the expense versus the advantages. One good way to do this is to try to influence brand new break even section. Including, if for example the closing costs try $2,400 and you are clearly saving $100 30 days on the the brand new loan, it takes 24 months (a couple of years x $100 30 days protected) to split actually and start protecting.

Refinancing can make economic experience once you reach your split-also part quickly. Whether or not it will take decade to-break also, you could select refinancing doesn’t seem sensible. The house refinance calculator can help you guess simply how much your you will help save from the refinancing.

Look Your residence Home mortgage refinance loans Broad Brook CT loan Alternatives

You can refinance a house that have a conventional, Va, FHA, otherwise USDA financing. What type you choose utilizes facts like your latest loan sort of, your financial wants, your own residence’s well worth, of course you have got mortgage insurance rates. Listed here is a closer look from the refinancing options.

- Antique refinances. There are numerous advantageous assets to Antique refinances. No matter the loan method of-Virtual assistant, FHA, otherwise USDA-you could potentially re-finance towards a normal mortgage. You could re-finance property this isn’t your primary home, as well as vacation homes and you will local rental otherwise capital characteristics. Just in case you have 20% guarantee or more of your house, you might usually avoid expenses mortgage insurance rates with your the brand new financing. Find out more about Traditional home loan refinances.

- Virtual assistant IRRRL improve refinances. Va streamline refinances render an easier and you may quicker means to fix down their rates or progress terminology than the Antique fund. For individuals who currently have good Virtual assistant financing consequently they are to day on the repayments, your line refinance.

- FHA improve refinances. An enthusiastic FHA improve re-finance is an excellent option after you currently very own a home with a keen FHA financing. The applying involves smaller files and it has easier borrowing from the bank conditions opposed in order to a traditional loan. not, once you re-finance an FHA loan just be sure to shell out mortgage insurance fees whatever the property value the residence’s equity. Learn more about FHA streamline refinances.

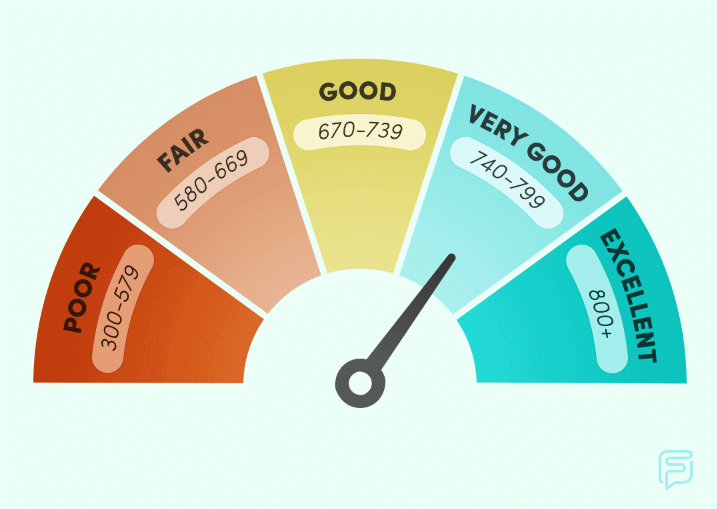

Remark Your bank account and you can Borrowing

Their eligibility for a loan refinance and the rate of interest i can offer you can believe your credit rating. In many cases, increased credit history makes it possible to score less rate. Definitely comment your credit score to make sure it’s precise. While you are your chances of delivering recognized to have a great re-finance function better with a high credit rating, Liberty Home loan could help you to get acknowledged which have a lesser get.

Determine Your loan-to-Value Proportion

The home’s current fair market value is utilized so you’re able to estimate the loan-to-really worth (LTV) proportion. Discover restrict LTV proportion issues that make an application for certain refinances, and you will probably have to meet these types of rates to be qualified. Just to illustrate out of exactly how good home’s LTV try calculated:

- Fair market value of your property was $250,000

- You’re refinancing it having an excellent $two hundred,000 home loan

- $2 hundred,000 ? $250,000 = 0.80

- Their LTV ratio try 80%

The low your own LTV is, the more likely you will be approved having refinancing. it may affect the rate of interest you are getting.

Find out the Rate of interest Liberty Mortgage Can offer You!

Freedom Mortgage might be able to offer a beneficial refinance attract speed that’s down or even more as compared to price you see given of the most other lenders. The interest rate you are able to receive from you depends on your own borrowing rating, income, money, current market requirements, as well as the version of refinance mortgage you desire. From the refinancing, the funds charges may be higher across the longevity of the borrowed funds.

Complete a mortgage Application and you can Papers

Very Conventional refinances requires you to definitely over a separate software and provide documentation. Streamline refinances normally have quicker papers and you may an easier software process than the Old-fashioned refinances. While you are a current Versatility Home loan customer, your line app because of the getting in touch with or going online. Find out more about simple tips to submit an application for a mortgage.

Remark Data files and you can Sit-in Closing

You will find several things should expect just after making an application for a home loan re-finance. You are going to have the initial revelation and certainly will must express your intent to follow the re-finance application in order to proceed. You might feedback and you can signal your own disclosures electronically just after providing your « e-consent » as opposed to having them shipped to you personally-this helps speed up the process.

The application would-be assessed from the all of our underwriting group. You might have to offer some a lot more paperwork. A prompt a reaction to these types of demands keeps the method swinging. When your loan might have been recognized, we will let you know and give you next procedures as well as a peek at their Closure Disclosure and you can scheduling a closing time. In the end, try to sit-in the closing in order to signal mortgage files and you will pay any settlement costs. Find out about all of our mortgage software processes.