None of one’s top 20 Virtual assistant loan providers was members of Very own Up’s financial network

****Average rate pass on compares all of the Virtual assistant money began because of the a lender inside the 2020 with the APOR in the course of origination. At the time of finishing this research we as well as examined new Greatest 20 lenders’ rates spreads inside a specific Virtual assistant financing objective (Buy, Re-finance & Cash-out Re-finance) therefore we receive comparable variability in the specific groups.

Virtual assistant financing studies analysis, 2020

One set of consumers which is adversely impacted by the new nefarious decisions from specific lenders is You Pros, who take into account more than 20% out of homebuyers depending on the Federal Organization regarding Realtors (NAR).

HMDA data investigation, 2020

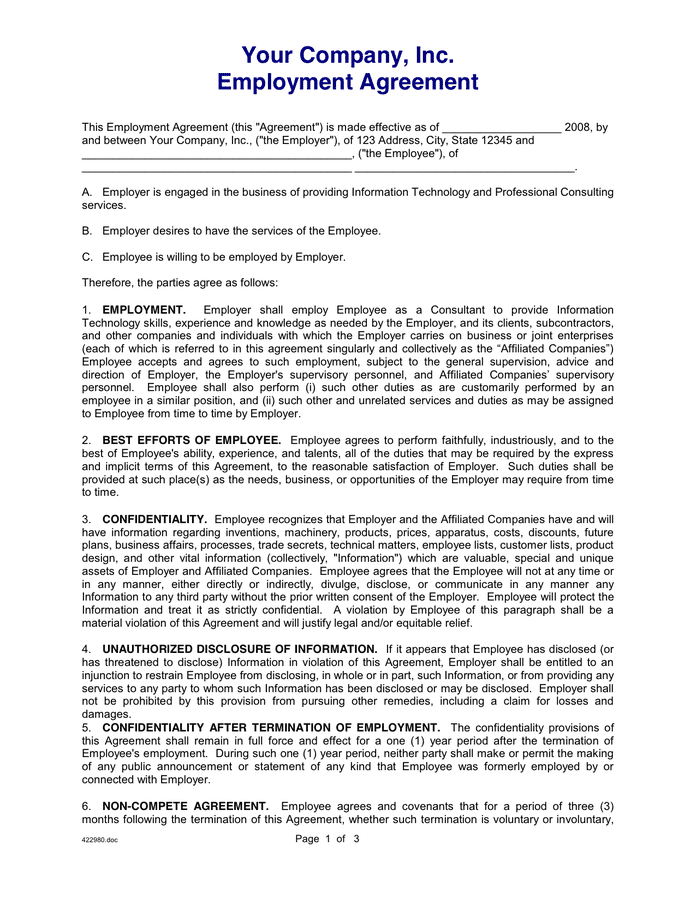

In order to confirm these results, we presented an analysis of information produced public because of the Household Financial Revelation Work (HMDA). HMDA is a federal act accepted for the 1975 that really needs home loan lenders to save records from particular trick bits of information about their credit practices, which they need certainly to yield to regulating bodies. It absolutely was followed by the Federal Set aside because of Control C. HMDA study shall be analyzed off some basics, like the rates of interest recharged from the lenders.

The study of HMDA analysis verifies that many mortgage lenders overcharge borrowers, specifically Us Experts. It desk means that of your own ideal 20 Va loan providers from inside the 2019, ten got a performance spread which had been above the Average Primary Give Rates (APOR)

***It list constitutes the top 20 Va loan providers inside the 2019, of the frequency. It was fashioned with purpose, in public areas readily available criteria and you may highlights brand new wider variability certainly economic effects across Va loan providers.

****Average price spread measures up all of the Va funds originated by a loan provider in the 2019 to the APOR in the course of origination. During doing this research we in addition to tested brand new Top 20 lenders’ price advances within a certain Virtual assistant financing purpose (Buy, Refinance & Cash-aside Refinance) and we also receive equivalent variability in the particular categories.

The conclusion

- Lowest pass on = -0.359

- Average bequeath = 0.04%

- Highest pass on = 0.889%

- Higher – Lower = step 1.25%

Predicated on these computations in the event that a borrower were to safe an excellent financing that have a loan provider for the reasonable Apr (APR) so you can APOR spread, which was Navy Government Borrowing Partnership, as opposed to the financial on large Annual percentage rate so you can APOR spread, which was New day Monetary, they’d safer an apr that is step 1.25% most useful. It table suggests the brand new feeling into the borrower:

I used an equivalent analysis to your Va money got its start because of the lenders throughout the Very own Up Lender markets. The typical rate give anywhere between Apr and you can APOR are -0.542%, which is 0.183% better than the fresh Va bank on the low interest levels in the the big 20 loan providers for the 2019.

Because we want all of our lender partners to remain below set prices standards as the a condition to be within our marketplace, we’re able to ensure that our users, in addition to men and women trying Va money, safe fair rates of interest.

What is apparent from your investigation would be the fact most of the consumers are not addressed just as. However, way more disturbingly, all of our veterans and the ones definitely helping on the military, residents exactly who would be revered for their solution to our country, are now being rooked by specific lenders. It is the hope this particular study factors lenders to test its costs guidelines, especially into Va financing, as it appears disingenuous to celebrate all of our veterans while you are while doing so overcharging all of them. Also, the guarantee using this type of analysis is to try to teach customers toward need for searching certainly one of numerous mortgage brokers before choosing you to. Studies off HMDA reveals unequivocally one to interest rates and you may settlement costs can vary commonly one of lenders, https://paydayloanalabama.com/coaling/ so it’s imperative that you see a lender that gives reasonable terminology.